Mexico’s Oil and Taxes

More on:

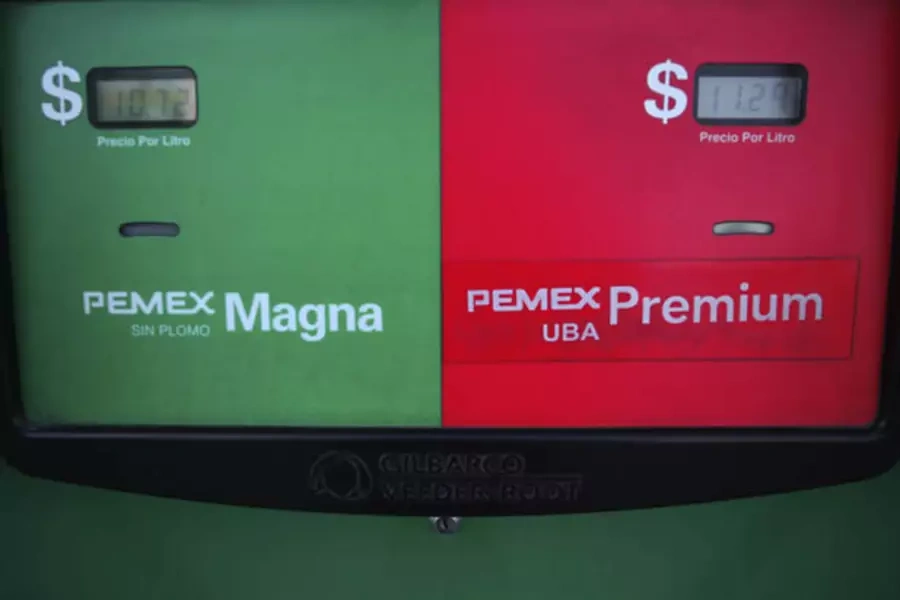

Over the last three decades, oil’s importance in the Mexican economy has diminished, with energy products shrinking from over three-quarters of all exports in 1982 to less than 15 percent in 2012. Still energy’s role in Mexico’s politics has not receded, in part due to the federal budget’s dependence on the sector—taxes and royalties comprise roughly a third of total inflows into government coffers. As the Congress negotiates the secondary legislation that will set the ground rules for opening up the energy sector in Mexico, the government will have to address this dependence as well, weaning itself from Pemex’s largesse.

Mexico’s tax system is broadly made up of taxes on hydrocarbons, income, corporate profits, goods and services, as well as contributions for social security. According to the National Institute of Statistics and Geography (INEGI), an autonomous government agency, Mexico’s Tributary Administration Service (SAT) collected roughly US$200 billion in federal, state, and local taxes in 2012. Of the federal inflows, some $70 billion (pre gasoline subsidy) came from hydrocarbons, $58 billion from income taxes, and another $50 billion from the value-added tax (VAT).

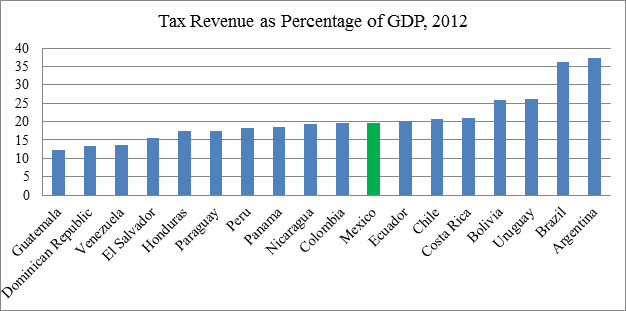

There are two basic ways that the Mexican Treasury can lower its dependence on oil. The first is to raise other taxes. At roughly 19 percent of GDP (including hydrocarbon revenues), Mexico’s tax burden is the lowest among the OECD’s member countries, where rates average closer to 34 percent. Within Latin America, Mexico is nearer to the regional median of 20 percent of GDP.

The government started this process with a 2013 fiscal reform. The new law removed VAT exemptions along the U.S.-Mexico border (standardizing the rate at 16 percent), raised income taxes for high earners, and introduced a tax on dividends, among other measures. The government predicts that the reform will raise revenues by 2.5 percent of GDP by 2018, though only by 1 percent in 2014 (roughly $12 billion).

Another avenue to fiscal solvency is better tax collection. A Global Financial Integrity study calculated that between 2000 and 2009, about $50 billion a year in illicit outflows were not taxed, nearly the amount collected in VAT or income taxes. Some of this $50 billion comes from illegal goods—drugs, contraband, and the like. But some of it stems from businesses avoiding taxes, reflecting one of Mexico’s most significant economic challenges: the immensity of its informal economy. Some 30 million Mexicans (six out of ten workers) are in the informal sector, not paying any taxes or contributing to social security. This tax loss adds up to an estimated 3 to 4 percent of GDP a year (some $35 to $50 billion).

As Pemex shifts from a state owned enterprise to a state productive enterprise, the government would be wise to diversify its revenue base. This will require some mix of higher taxes and better tax collection. One is never popular, the other requires stronger institutional capacity; but both will likely be necessary to replace Mexico’s easy energy money.

More on:

Online Store

Online Store